Accounting and Taxation Services

Can I prepare book-keeping and tax filing by myself?

Yes, definitely. We can help to set up the system and guide you on updating your accounts. We can also help to review your accounts before compiling the financial statements for submission and filing to ACRA and IRAS.

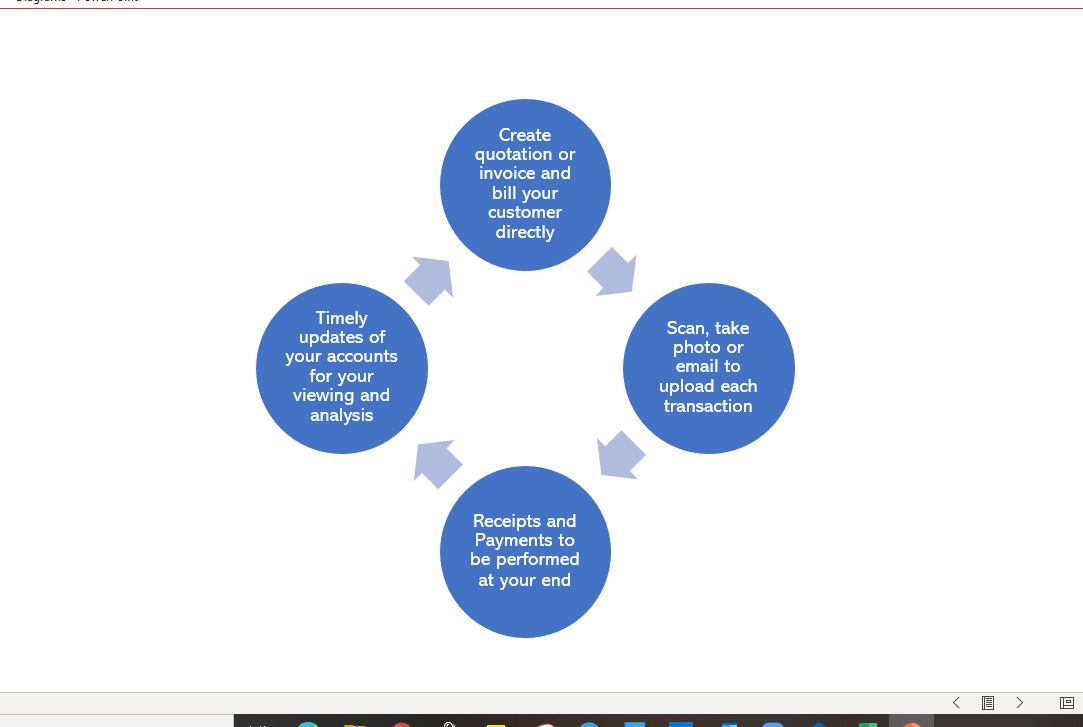

In KBX Resources, we will work with you to design a workflow to suit your needs and set the protocols with you to ensure proper recording of transactions and necessary documentation in placed.

Why do we need to prepare accounts on a regular basis?

In business, you will constantly need to make decisions after decisions. Without an insight of how your business is doing or whether your promotions are showing results, you are likely to encounter deep learning curves in your entrepreneurship.

Having a prompt update of your accounts allows you to follow up with outstanding receivables, manage costing to ensure that you are pricing your products and services adequately to keep your business alive and etc.

What can an Outsourced/Virtual Accountant do for me?

Our Chartered Accountants are trained and experienced in picking up errors in your recording (if any), analyse your costings and other financial information depending on your requirements, and design your workflows to reduce your needs in relying on additional manpower.

Having a clearer process will help your staff to work more efficiently and improve overall productivity and staff motivation!

Keen to find out how much is the cost difference in employing an Accountant and engaging an outsourced Accountant? Find out more information here (scroll to the bottom of the page).

Our Book-keeping, Accounting and Taxation Fees

We offer standard packages for our clients. However, each company may have different needs and volume of transactions. Hence, we also customize our services and fees to meet your requirements.

To get a quote on our customize services and fees, please contact us for more information.